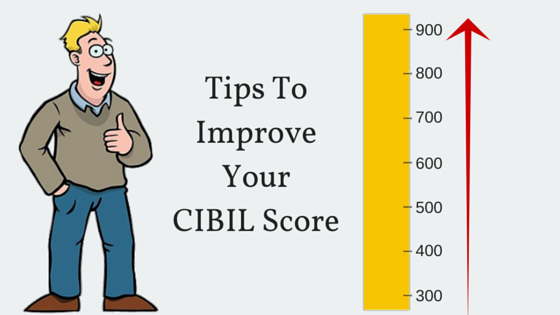

7 Effective Ways To Improve Your CIBIL score

A Bad CIBIL score can be a nightmare for people who have an urgent need of money because of things like medical emergencies, debt repayment and any other such thing where getting a loan becomes the only option.

There are many ways to get loans and the criteria is totally based on the size of the loan but all banks are compulsorily required to verify the CIBIL score of the applicants of all financial products of credit, namely loans and credit cards. This is the mandated Reserve Bank of India guideline to establish the creditworthiness of individuals. Therefore, if a person has poor CIBIL score, it simply means that he is not creditworthy enough to get a loan from conventional sources of finance because of their past actions.

But with some efforts, a person with bad CIBIL score can improve his rating and can become creditworthy again.

Here are 7 Effective methods to improve CIBIL score

Understanding the Scoring Pattern

Before anything, first understand what is a CIBIL report and its scoring pattern.

So, an individual's CIBIL report essentially means a database and track record of all the past loans or credit cards with his/her name along with repayment history for regularity or irregularity as the case may be. This data helps to establish the 'financial behavior and financial discipline' of the individual and helps the banks to extrapolate the intent for repayment in future based on this the available data with your current actions and estimates of your current financial needs.

Watch this video to understand how CIBIL works

The scoring pattern of the CIBIL score ranges on a point scale of 300 to 900 with 300 being the lower end of the rating scale and 900 points being the highest creditworthiness rating scale of the individual.The higher score an individual is able to garner, the higher the probability of attracting lenders to queue up to offer better and better deals on loans. If you understand the scoring pattern, you are on right track to follow the next few steps to improve your CIBIL rating score card.

1. Clean the Credit Card

Clearing off all your credit card outstanding dues is a vital key to improve your rating. Plan your credit card spending in such a manner that you clear off your credit balances before the due date. This will go a long way to positively reinforce your CIBIL score. Good financial behavior and discipline is what lenders seek in their customers.

So, first and foremost clear off all the outstanding dues because unpaid outstanding amount month-on-month will reduce your score considerably. Possessing just one or maximum two credit cards is the way to go as it curbs your spending instincts plus it is easier to pay your outstanding amount in time and keep a check and track of your spending behavior.

2. Inaccurate Appeals

An individual must make sure that any errors in your credit report are appealed by the individual on the CIBIL website (www.cibil.com). Appeal only if you have a valid point of disagreement. Errors can happen and lenders also could make some typographical data entry errors and even software's are not immune from errors.

If any appeal to rectify reported error is pending, it is mandatory for the lender or financial agency/institution to address the appeal within a timeframe of one month (30 days). Once the error is rectified and addressed, the individual's credit rating score also automatically improves. Always apply for fresh credit only when the older loans or outstanding amounts are totally cleared. It always helps to get loan when you start with a clean slate.

3. Use The Oldest Credit Card

It is erroneously believed that credit card accounts no more in use should be deactivated. This is because mostly people are oblivious about the impact that it has on an individual's CIBIL report. Realistically, a good credit card account over a long period of time that has been managed well with timely payments of outstanding is a blessing in disguise. This gives the much-needed impetus to enhance the CIBIL score. So, the crux of the matter to improve creditworthiness is that a robust repayment track record of your credit card must be continued and held on as long as possible. The longer you hold a positive credit card repayment history the better your CIBIL rating scores.

4. Equated Monthly Installment Payments

When big ticket purchases are being made by an individual, like a four wheeler or apartment or piece of residential land, you will never be eliminated from consideration if you are prompt in repaying the EMIs on your credit card account. So, paying equated monthly installments of your past bigger loans on time will help in improving your track record to pay bigger amounts and thereby getting a higher CIBIL score/rating.

An individual possessing a decent amount of savings coupled with a good repayment track record of credit card bills enhances the rating.

5. (i) The 30% rule of credit utilization

Never ever use your credit card to buy each and everything. You have to keep the 30% rule in mind of credit utilization. Never exceed more than 30% of credit utilization and this will establish not only your credibility for financial discipline and financial management, but will also take your CIBIL score soaring with positivity. When your monthly saving balance is low, it will benefit to reflect a positive CIBIL score.

(ii) Enhanced credit limit

Whenever your rating is good, the bank will offer to enhance your credit limits on your credit card and never refuse to get an enhanced credit limit. It need not mean that you have to spend more but it only reflects the confidence of the bank in you. You can also ask your bank to increase your credit limit, as enhanced credit limit always has inherent plus points from rating agencies. In a nutshell, it effectively means you have more credit at your disposal but you maintain your utilization below 30% of your credit limits. So, the 30% utilization rule and getting enhanced credit limit is very important for a higher rating on the CIBIL scale.

6. Information on secured card

Just in case an individual has a bad CIBIL score, then getting a secured card from leading banks against a fixed deposit is the way to go. Leading banks like Axis Bank, ICICI Bank, Kotak Mahindra Bank, SBI, etc. offer a secured credit card against a traditional investments of nominal amount. When you repay your balances on time, the CIBIL score soars high.

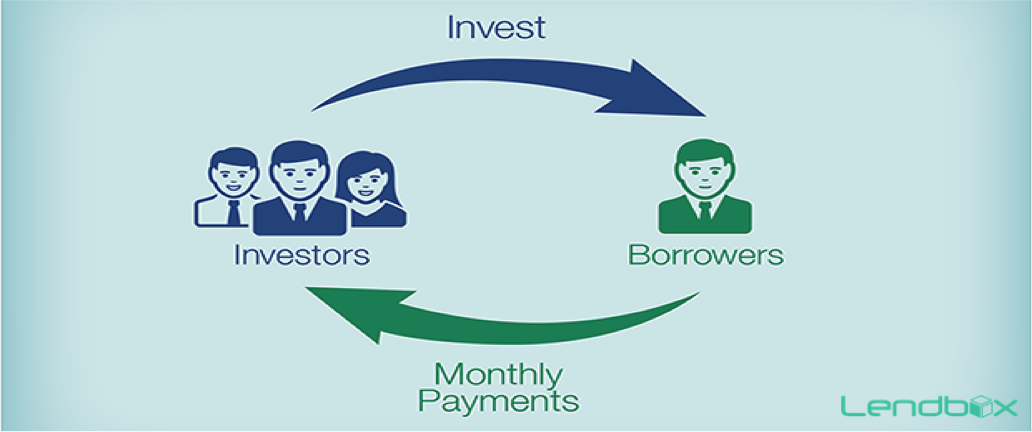

7. Improving rating through Peer-to-Peer Platform

One of the most effective yet not very known way to improve CIBIL score is using a peer to peer lending platform like Lendbox. There are many benefits of borrowing from a peer to peer lending platform. Unlike banks, Lendbox allow people with poor CIBIL score to register on the platform as long as they have valid reasons for their credit history. Getting a small short-term loan from Lendbox is really easy and there are no charges on prepayment. Repaying on time will improve your score on the CIBIL rating system too. If you do not know what Lendbox platform is all about, just search for how peer-to-peer system works and prepare to get your CIBIL ratings improved in the long run.