Your access to

effortless and stress-free

investing

Say goodbye to low returns and uncertainty due to volatile markets. Grow your idle capital with fixed and consistent annual returns of up to 11.55% investing through Per Annum.

Start with only ₹50,000, no investment fees and charges!

100% liquidity

Interest Credited Daily

No investment fee

100% Repayment History

Already have an account?

Start with only ₹50,000 no investment fees and charges!

SIP starts at ₹5000 only.

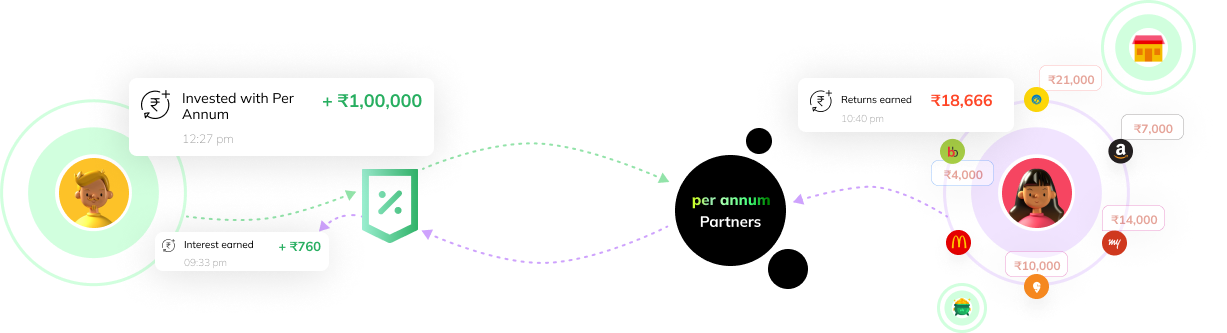

How it works

Invest in India's leading professionals with per annum

When you invest with us, your money is deployed directly to highly creditworthy borrowers sourced through our premium fintech Partners, as borrowers use the given credit, you get to earn interest on your capital everyday.

Invest on your own terms

Flexible investment horizons

Fixed-term investment

Your investment will be locked in for the duration of your choosing, efficiently compounding your returns

Earn up to 11% per annum

Minimum tenure of 12 months

Minimum investment of ₹1 lakh, maximum ₹50L

No TDS on withdrawal

No Investment Fee

Monthly Interest Payout (Optional)

Flexi investment

For those who want to keep their money invested with adequate liquidity. You can withdraw your investment with interest anytime

Earn up to 9.5% per annum

Minimum investment of ₹50,000

No minimum tenure

No TDS on withdrawal

ZERO deposit or withdrawal charges

Daily Interest Credit

India's Next Break-through

Investment Product

I have been a huge fan of the Settlement Financing investment for the last 2 years. I have made upwards of 12% a year. Recommended the same investment to my friends too. Lendbox team has been helpful in clarifying my doubts about associated risks

Aman Tandon

Modinagar, U.P.

I have been a huge fan of the Settlement Financing investment for the last 2 years. I have made upwards of 12% a year. Recommended the same investment to my friends too. Lendbox team has been helpful in clarifying my doubts about associated risks

Any questions?

If you need help getting started, managing your portfolio or if you’re wondering whether Per Annum is the right choice for you, these frequently asked questions may help.

What is Per Annum?

Per Annum is an investing platform powered by RBI registered NBFC-P2P, Transactree Technologies Pvt Limited (referred as Lendbox) . At Per Annum, we enable lending to the top 2% of India’s most creditworthy people. Borrowers on Lendbox are sourced through our Tier 1 partners. These companies are top-order credit risk managers catering to those with unblemished repayment histories. Investments in Per Annum products earn interest income which the investors can choose to reinvest, take advantage of compounding or withdraw directly into their bank accounts.. Lendbox will invest the funds in different borrowers based on its algorithm and keep reinvesting repayments in new borrowers for optimizing the returns.

What risk mitigation measures does Per Annum have in place?

Per Annum is powered by NBFC-P2P Lendbox which follows best-in-industry underwriting practices with stringent cut-offs for credit scores as well as repayment history. On average, borrowers accepted for financing via Lendbox have a credit score of 700 or above with regular repayment histories spanning 5+ years. Our Partners, who aid us with loan collection in addition to risk assessment, also have on-ground fleets of collection agents in most of the cities. Alternative data, income and spending behaviour are other important parameters while assessing borrowers for Lendbox.

Does Per Annum guarantee my investments? What if there are delays or defaults?

No. In accordance with RBI master directions, Lendbox does not guarantee or provide any security for the investors’ returns. All investments are subject to actual repayment performance of the loan. All investments are subject to actual repayment performance of the loan. However, each and every loan is disbursed after stringent credit checks to ensure high quality loan portfolio. Lendbox has dedicated in-house collection team as well as tie-ups with authorized collection agencies to collect and recover the loans given out via Platform. They also have arrangement with their loan sourcing partners to collect the loans for us which gives an access to huge collection fleet in all major cities. With high quality borrowers coupled with string collection and recovery mechanism, our delay and defaults remain very low to ensure the expected returns are delivered to the investor

How can I withdraw my investment under the Flexi investment plan? Is this permitted under RBI regulations?

You will be able to request for withdrawal of your funds (principal and interest earned) from our app any time. After receiving your withdrawal request, our system queues up your ongoing investments to be ‘sold’ on the secondary market to other investors waiting to deploy their funds. In ideal conditions, this should only take up to few hours and the money will be credited to your account in a few working hours. Note that Lendbox is a P2P-NBFC and each transaction must be processed through our trustee-regulated escrow accounts. We are limited by banking holidays and trustee working hours. In the unlikely scenario that no investors are available to buy your investments, this process may take a few days. You will continue to earn interest until the day before funds are liquidated by selling the loans to other investor.

100% On-Time Repayment History

Per annum takes the safety of your funds very seriously, hence all the transactions are encrypted with 128-bit ssl protections and funds are routed through escrow accounts. Per annum has robust risk mitigation for delivering safe returns with a history of 100% on-time repayments.

Sign Up Now

About Per Annum

Per Annum is building India’s largest platform for alternate and fixed income investments, unlocking a large basket of investment products previously unavailable to the Indian retail investor.

Our goal is to introduce the Indian retail investor to products beyond the age old, fixed income products which barely beat the prevailing inflation rate. It is time that the Indian investor gets access to products which are immune to the volatility of the stock markets all the while earning a healthy return of up to 11.55%.

Your personal wealth manager

A dedicated relationship manager will help you make better financial decisions and grow your money.

Track your investment performance

Everything you need to control your Per Annum investments is available in a single app.

High quality, consistent returns

Wide range of financial products based on your preferences. Make informed decisions and retain complete control of your portfolio.